In 2025, the technology investment landscape is increasingly bifurcated. On one side stands artificial intelligence (AI), attracting unprecedented capital flows and dominating headlines with its transformative promise. On the other side lies climate tech that is facing a critical funding deficit as generalist investors pivot toward faster, lower risk returns in AI and digital technologies. This reallocation of capital is not merely a shift in preference but a systemic misalignment between capital markets and long-term planetary needs. Yet, a solution exists: strategic, catalytic grants capable of de-risking innovation and sustaining momentum through the arduous journey from lab to market.

The Surge in AI and the Decline of Climate Tech Investment

The scale of investor divergence between AI and climate tech is stark. In 2023 alone, AI companies raised nearly $100 billion in equity funding, while climate tech venture funding declined by $20 billion, dropping to just $32 billion, according to Bloomberg data. This contrast reflects the investment community’s growing appetite for rapid scalability and capital-light business models that characterize AI ventures.

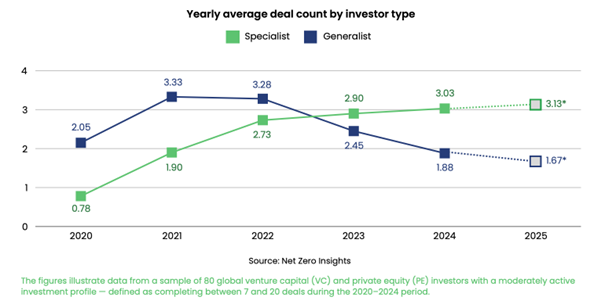

Generalist investors who typically manage diversified portfolios across sectors, have been quick to reallocate capital. According to Net Zero Insights Q1 report, their participation in climate tech, which peaked between 2021 and 2022, fell sharply in 2024 and remains subdued in early 2025. The review of 80 global VC and PE firms in Figure 1 shows a decline that closely mirrors the overall contraction in climate tech funding, highlighting the outsized influence generalists exert on market dynamics.

Figure 1 Illustration of data from a sample of 80 global VC and PE firms.

This shift is not unfounded. AI’s energy-hungry growth, driven by large language models and data-intensive processes, has proven commercially promising and industrially disruptive. However, it comes with steep environmental costs. U.S. data centers are projected to consume up to 11.7% of national electricity demand by 2030, up from 1% before AI’s boom.

Climate Tech: High Stakes, Long Horizons

Climate tech, by contrast, continues to face structural barriers. Many of its innovations such as enhanced geothermal, long-duration storage, carbon capture, and small modular nuclear reactors (SMRs) require years of research, extensive permitting, and large-scale infrastructure deployment. These timelines are incompatible with the short-term return expectations that guide most generalist investors.

Compounding the challenge, mid-sized climate tech funds ($100M–$500M) have remained active, but smaller and mega-sized funds experienced declines in 2024 amid increasing fundraising challenges. Over half of investors surveyed reported significant obstacles, citing a more selective limited partner base, tighter capital markets, and a heightened aversion to early-stage risk.

A significant withdrawal of capital is jeopardizing progress in sectors crucial for deep decarbonization. However, the U.S. federal government is addressing this challenge through ambitious R&D initiatives in key areas funded by federal and state grants. For instance, The Department of Energy (DOE) has aimed to reach 5 GW of capacity by 2030 in the first stage of its Liftoff program and to slash geothermal cost per megawatt hour by 90% by 2035 through the Enhanced Geothermal Shot initiative. Similarly, nuclear power has shown signs of resurgence e.g., Microsoft’s reopening of Three Mile Island and Texas’s new Nuclear Renaissance Bill, but construction and regulatory hurdles still impede rapid deployment.

The Role of Strategic Grants in Reversing the Trend

As generalist investors focus on faster-scaling sectors, many early-stage climate tech companies are finding it increasingly difficult to attract private capital. But this gap in private investment also reveals an important opportunity: strategic grants.

Across the U.S., there is a diverse ecosystem of non-dilutive funding from federal and state agencies to philanthropic foundations and mission-aligned corporations stepping in to support climate innovation. These strategic grants do more than fill financial gaps. They validate technologies, reduce risk, attract follow-on funding and accelerate time to deployment. For startups struggling with uncertainty, a well-structured grant strategy can be a growth engine, not just a stopgap.

Based on proven frameworks, the following Strategic Grant Roadmap for Startups outlines the critical stages of successful grant pursuit and deployment:

1. Landscape Intelligence

Early-stage startups often miss opportunities not due to lack of merit, but due to lack of visibility. The first step is mapping the full spectrum of available grants, federal programs (e.g., DOE, NSF, ARPA-E), state and regional clean energy offices, philanthropic accelerators, and hybrid public-private partnerships against your stage of development and sector fit.

2. Readiness and Fit Assessment

Each grant has specific goals, timelines, and eligibility criteria. Evaluating your startup’s technical maturity, commercialization pathway, and team capacity ensures time is spent targeting funders where you are competitively positioned, not just eligible.

3. Narrative Development and Technical Framing

Grant proposals are not just applications, they are arguments. Winning proposals articulate a clear value proposition: What problem are you solving? Why now? Why this team? How will you achieve measurable impact? Crafting this story backed by data, market insight, and policy relevance is critical.

4. Strategic Partnerships and Consortium Building

For FOAK (first-of-a-kind) projects or demonstration pilots, funders increasingly prioritize collaborative models. Startups can strengthen proposals by aligning with national labs, municipalities, corporates, or academic institutions, especially when addressing grid, transportation, or industrial decarbonization challenges.

5. Proposal Execution and Compliance

From budget preparation to milestone planning, the proposal process is highly technical. Effective grant strategy includes aligning deliverables with funder expectations and ensuring compliance with federal cost principles, reporting guidelines, and environmental standards.

6. Post-Award Leverage and Scaling

Winning a grant is not the finish line, it’s a launchpad. The most effective grant strategies plan for what comes next: using early-stage public funding to de-risk innovation and unlock later-stage capital from venture firms, infrastructure funds, or corporate strategic investors.

Through this structured approach, strategic grants can help startups to:

- Accelerate R&D without equity dilution

- Demonstrate market viability through real-world pilots

- Attract private follow-on funding by de-risking early-stage milestones

- Position for regulatory readiness and infrastructure integration

- Establish credibility with customers

Given the long timelines, capital intensity, and system-level impact of many climate tech solutions, strategic grants are not ancillary, they are foundational. These grants offer a decisive competitive edge but only if secured and managed with intention.